4 tools to improve your website’s conversion rate

Each brand has different goals for its website: more ebook downloads, more subscriptions, more webinar registrations, more sales, etc.

Therefore, it will be useless for you to have done a thousand and one actions to generate more web traffic if you have not focused on lead generation, such as with a good frequency of publications on Facebook.

4 tools to improve your web conversion

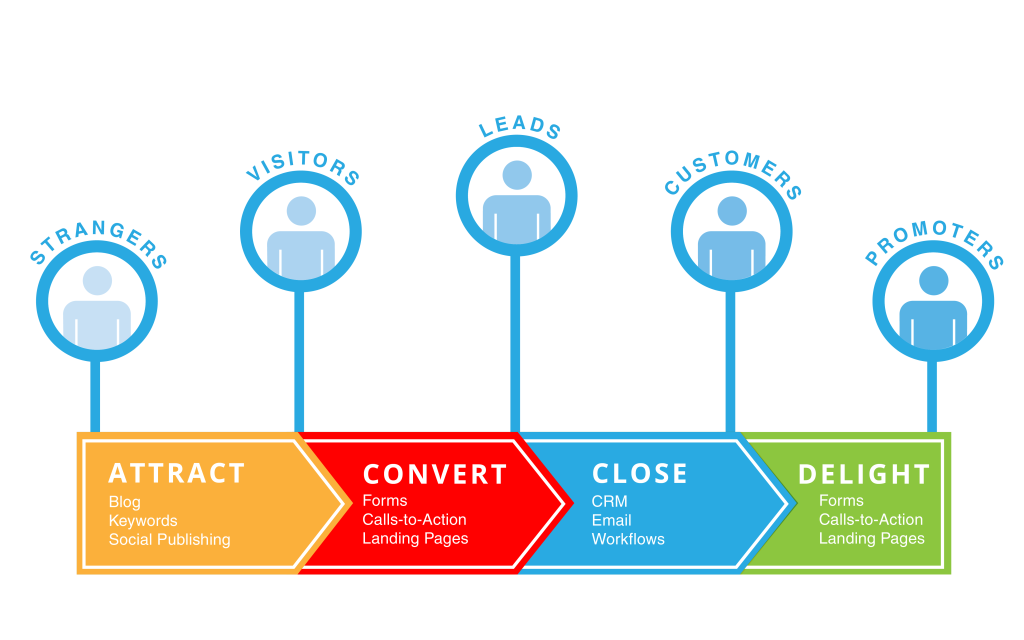

Every action that revolves around increasing web traffic should be related to conversions. We can have many visits, but the most important thing is to translate those anonymous visits into people with faces and eyes. We must get a user to let us know them better, give us their trust, and give us their data.

It is essential to be there to serve them properly, and more than a contact, it is to convert them into a lead, in marketing terms.

Therefore, converting doesn’t just involve generating web traffic; it involves research and marketing efforts.

Simple actions such as changing a CTA button or knowing data from your social networks, such as who is not following me on Twitter or Facebook, can make a difference.

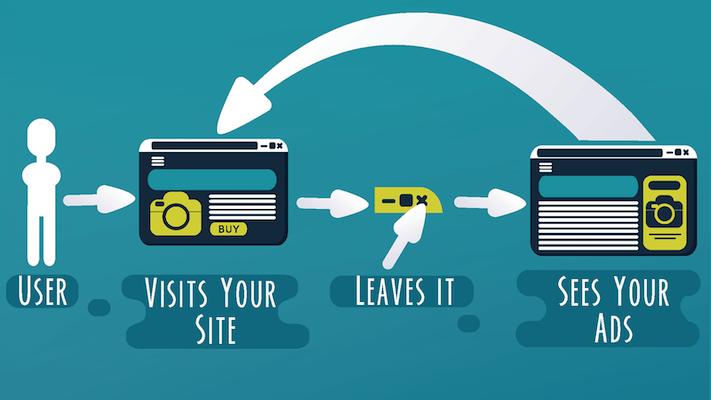

Increased traffic can help the conversion rate of the website improve considerably.

However, if you don’t have enough information about your customers, you won’t be able to know what factors to improve on your website, in order to make their experience more enjoyable.

That is why I want to present you with 4 tools that will become your best allies to collect necessary data and improve the conversion rates of your page in less time.

1# Postcron Newsletters

Speaking of each brand having its objectives, some strategies work well and include the delivery of weekly or daily newsletters (it all depends on your proposal), in which material of interest is provided to your subscribers.

This is a good idea to improve the conversion rate of your website; however, having a tool like Postcron Newsletters makes it even simpler and even fun.

This tool will allow you to easily add images, links, and titles to your newsletters to schedule and send them in bulk automatically.

For added confidence, they let you take a free trial to create your newsletter to save time and invest in your other marketing efforts.

2# Google Analytics

It will always be good to have a tool from the Google giant to manage any type of campaign within your online marketing strategies.

In this particular case, Analytics helps you to know the behavior of your users, which, as we mentioned before, is important to have as much information about your leads to know what to improve on the website and thus increase the conversion rate.

If you want to know about sales trends and get real-time reports, this tool will be very useful. With the reports, you will be able to know the reactions of your users and thus optimize or adjust what needs to be changed.

3# The Five Second Test

The design of your website is just as important as its content. No one will want to stay for a long time in a place where there is no striking, coherent, and understandable design.

Poor design can have an impact on the drop in your conversion, and no one wants that to happen.

That’s why I want to tell you about this tool that is all about creating the best possible first impression of your website.

This will do this by introducing various types of design to your users and letting you know which of them your visitors are most comfortable with.

The procedure is as follows: the tool will show your client, for five seconds, a design. Then, he will ask you what you remember about that design.

By knowing different opinions, you will know more or less how to improve your users’ experience on your website, at least as far as design is concerned.

4# Formstack

If you have a lot of likes on Facebook or many followers on other social networks, we congratulate you, because they are platforms that you can also rely on to increase the conversion rate of your website.

But forms are critical to getting really specific data into our hands.

That’s why Formstack will help us create signup forms that not only work to collect data, they also work to make custom surveys and to create forms for other platforms of your ecommerce, such as the social networks we mentioned before.

To conclude, it is incredible the support that these tools can give you in terms of improving the conversion rate of your website, because at the end of the day, you owe it to your audience, and these tools will make you reach them in the right way.

Conversion is not achieved easily, but any tool to optimize, even if it is gradual, will always be welcome, and you lose nothing by trying.